The Art and Science of Pricing

In the fiercely competitive world of business, pricing isn’t just a number tagged on a product or service; it’s a multifaceted strategy that can make or break a company’s success. This strategic importance of pricing is where the art meets the science in business management. The right price can attract customers, build loyalty, and increase market share, whereas the wrong price can do just the opposite. For businesses aiming to thrive, especially in markets crowded with competitors, mastering effective pricing strategies is not just beneficial – it’s essential.

The Tools of the Trade

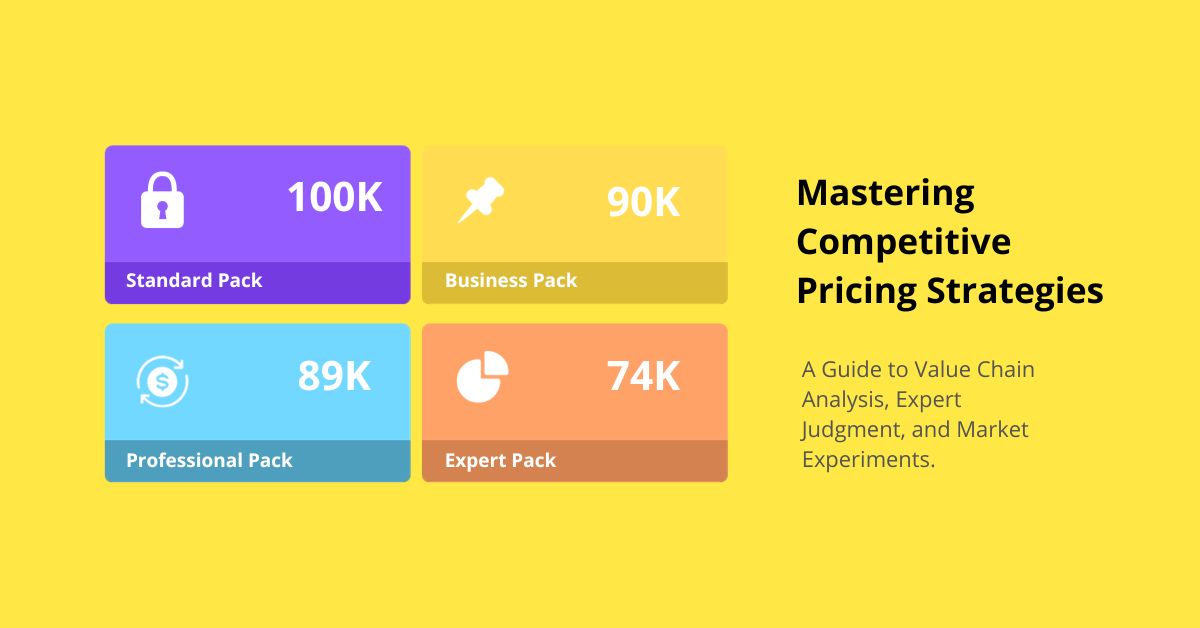

To navigate the complexities of pricing, businesses can leverage various tools and methodologies. Among these, three stand out for their effectiveness and widespread application: Value Chain Analysis, Semi-Quant Expert Judgement, and Experiments. Each tool offers a unique lens through which businesses can view and optimize their pricing strategies.

- Value Chain Analysis delves into the internal processes of a company, dissecting each step of production or service delivery to identify where the most value is created for the customer. This analysis helps businesses understand their cost structures and pinpoint areas where they can differentiate themselves from competitors.

- Semi-Quant Expert Judgement blends quantitative data with the qualitative insights of industry experts. This approach recognizes that numbers alone can’t capture the full picture; the experience and intuition of seasoned professionals are invaluable in interpreting data and making informed decisions.

- Experiments, such as A/B testing, offer direct insight into customer preferences and behaviors. By testing different pricing strategies in the market, businesses can gather concrete data on what works and what doesn’t, allowing them to tailor their prices based on actual customer responses rather than theoretical models.

Aiming for the Top

The ultimate goal of these tools is to empower businesses to develop pricing strategies that not only meet their revenue and profit objectives but also place them a step ahead of their competitors. In today’s dynamic market environment, where consumer preferences and competitive landscapes can shift rapidly, having a robust, flexible, and informed approach to pricing is more important than ever.

In the following sections, we’ll explore each of these tools in depth, providing insights and examples to illustrate how they can be effectively employed in crafting winning pricing strategies. Whether you’re a startup trying to find your footing or an established player looking to refine your approach, understanding and applying these tools can be your key to pricing success in a competitive world.

Value Chain Analysis in Pricing Strategy

Understanding the Value Chain

Value Chain Analysis, conceptualized by Michael Porter, is a methodical approach that businesses use to understand their internal processes and how each step contributes to the value delivered to the customer. This analysis allows companies to see where they can create the most value, enabling them to optimize their operations and pricing strategies.

The Process of Value Chain Analysis

- Identifying Primary and Support Activities: The first step involves breaking down the company’s operations into ‘primary’ (e.g., production, marketing, sales) and ‘support’ activities (e.g., human resources, technology development). This categorization helps in understanding the direct and indirect contributions of each activity to the final product or service.

- Analyzing Cost and Value: Each activity is then analyzed in terms of the cost it incurs and the value it adds. The cost includes not just the financial aspect but also time and resources. The value is measured in terms of its contribution to customer satisfaction and willingness to pay.

- Benchmarking Against Competitors: Comparing these activities and their cost-value contribution against competitors provides insights into areas of strength and weakness. This benchmarking is crucial for understanding a company’s competitive position.

- Optimizing for Competitive Advantage: Based on this analysis, companies can make strategic decisions about where to reduce costs, where to add value, and how to differentiate their product or service from competitors. These decisions directly inform pricing strategies, as they highlight areas where a company can justify a premium price or need to be cost-competitive.

Case Study: XYZ Electronics

For instance, consider XYZ Electronics, a manufacturer of smart home devices. Through Value Chain Analysis, they discovered that their customer support and after-sales service were highly valued by customers but also costly. By streamlining these services and investing in more efficient support technologies, they were able to maintain high customer satisfaction while reducing costs. This adjustment allowed them to price their products more competitively without sacrificing quality or customer experience.

Challenges and Considerations

- Complexity: Analyzing each activity in detail can be complex, especially for larger organizations with multiple products or services.

- Dynamic Market Conditions: The value chain is not static. Changes in technology, customer preferences, and competitive actions can shift the value of different activities over time.

- Resource Allocation: Deciding where to allocate resources based on this analysis can be challenging, especially when balancing short-term costs with long-term value creation.

Conclusion

Value Chain Analysis is a powerful tool for understanding how a business creates value and where it can optimize its processes for competitive pricing. By carefully dissecting and analyzing each part of the chain, businesses can make informed decisions that not only reduce costs but also enhance customer value, leading to more effective and competitive pricing strategies.

Semi-Quant Expert Judgement in Pricing Strategy

Blending Data with Expertise

In the rapidly evolving business landscape, pricing decisions can no longer rely solely on traditional quantitative analysis. This is where Semi-Quant Expert Judgement comes into play. It represents a symbiosis of data-driven insights and the nuanced understanding of industry veterans. This approach acknowledges that while data provides the backbone of analysis, the subjective insights of experienced professionals are crucial in interpreting this data in context.

The Essence of Semi-Quant Expert Judgement

- Data Collection: The process begins with gathering quantitative data – market trends, competitor pricing, consumer behavior, and other relevant metrics. This data serves as the foundation, offering a measurable and objective view of the market.

- Expert Panel Selection and Consultation: The next step involves assembling a panel of experts. These individuals are typically seasoned professionals with deep industry knowledge and experience. They are tasked with interpreting the data, considering factors that aren’t immediately apparent in numbers alone, such as market sentiments, emerging trends, and competitor strategies.

- Integration of Data and Expertise: The core of Semi-Quant Expert Judgement lies in the integration of this quantitative data with the qualitative insights from the expert panel. This combination allows for a more holistic view of the pricing landscape, taking into account both the hard facts and the subtleties of the market.

Advantages and Limitations

- Benefits: This approach offers a more rounded and realistic perspective, as it combines the objectivity of data with the subjective insights of industry experts. It is particularly useful in scenarios where data is incomplete or too complex to be solely understood by statistical models.

- Challenges: One primary challenge is ensuring the objectivity and diversity of the expert panel. There is also the risk of cognitive biases affecting the judgement of experts.

Case Study: ABC Apparel

Consider the case of ABC Apparel, a fashion retailer. When deciding on pricing strategies for their new line, they first analyzed consumer purchasing patterns and competitor pricing strategies. Then, they consulted a panel of fashion industry experts. These experts provided insights on upcoming fashion trends, consumer preferences, and potential market shifts. By integrating these insights with their data analysis, ABC Apparel was able to set dynamic pricing that not only matched consumer willingness to pay but also preempted future market trends.

Methodological Considerations

- Selecting the Right Experts: The effectiveness of this method hinges on the quality and diversity of the expert panel. Experts should be chosen not just for their experience but also for their ability to provide diverse perspectives.

- Balancing Data and Judgement: Striking the right balance between quantitative data and expert insights is critical. Over-reliance on either can skew the decision-making process.

- Continual Reassessment: Markets are dynamic, and so should be the application of Semi-Quant Expert Judgement. Regular reassessment with fresh data and expert opinions is necessary to stay relevant.

Ethical and Practical Implications

- Transparency and Ethics: In implementing this approach, companies must maintain transparency, especially when expert judgements might significantly influence pricing decisions that affect consumer perceptions and market fairness.

- Practical Application: The practical application of this method varies across industries and market segments. Its effectiveness is influenced by the nature of the product or service, market dynamics, and the availability and quality of data.

Conclusion

Semi-Quant Expert Judgement bridges the gap between numerical data and real-world complexities. In the realm of pricing strategy, it provides a more nuanced and adaptable approach, essential in today’s ever-changing market environments. By effectively combining quantitative analysis with the wisdom and intuition of industry experts, businesses can make more informed, responsive, and competitive pricing decisions.

Experiments in Pricing Strategy

Embracing Experimentation in Pricing

In the quest to find the optimal pricing strategy, businesses are increasingly turning to experimental methods. These experiments, grounded in scientific principles, offer direct insight into how consumers respond to different pricing models. This approach is particularly valuable in today’s dynamic market, where traditional methods may fall short in capturing the nuances of consumer behavior and preferences.

Designing Pricing Experiments

- Setting Objectives: The first step in conducting a pricing experiment is to define clear objectives. What does the business want to learn? This could range from understanding price elasticity, testing consumer response to price changes, to identifying the optimal price point for a new product.

- Selecting Variables: Key to any experiment is the selection of variables. In pricing experiments, these typically include different price points, customer segments, or even packaging and marketing messages that accompany the price.

- Creating Control and Experimental Groups: Like any scientific experiment, pricing experiments require a control group and one or more experimental groups. This setup allows businesses to isolate the impact of the pricing variable being tested.

- Implementing the Experiment: Implementation can vary, from online A/B testing where different groups are exposed to different prices, to field experiments in physical stores or markets.

Analyzing Results

Once the experiment is complete, the data collected is analyzed to draw conclusions. This analysis can reveal how sensitive customers are to price changes, which price points are most effective, and how different segments react to pricing strategies. This information is invaluable for making informed pricing decisions.

Case Study: DEF Software

For example, DEF Software, a SaaS company, used A/B testing to determine the pricing for its new project management tool. By offering different price points to different user groups, they were able to gauge the price sensitivity and willingness to pay of their target market. The experiment revealed a higher-than-expected willingness to pay among small business owners, allowing DEF Software to adjust their pricing strategy for this segment accordingly.

Risks and Ethical Considerations

- Risk of Alienating Customers: If customers become aware that they are part of a pricing experiment, especially if they are paying more than others for the same product, it can lead to negative perceptions and harm the brand.

- Ethical Implications: There are ethical considerations in how the experiments are designed and communicated, particularly in ensuring transparency and fairness.

Integrating Experimental Insights into Pricing Strategy

The insights gained from pricing experiments should be integrated into the broader pricing strategy. This integration involves:

- Adjusting Prices Based on Findings: If an experiment shows that customers are willing to pay more, or less, than the current price, adjustments should be made accordingly.

- Segmented Pricing Strategies: Experiments can reveal how different customer segments react to pricing, allowing businesses to tailor their pricing for each segment.

- Dynamic Pricing Models: The data from experiments can feed into dynamic pricing models, where prices are adjusted in real-time based on demand, competition, and other factors.

Conclusion

Experiments in pricing are a powerful tool in the arsenal of modern businesses. They provide direct feedback from the market, allowing companies to tailor their pricing strategies based on actual customer behavior and preferences. However, the design and implementation of these experiments must be approached with care, considering both the potential risks and the ethical implications. When conducted and integrated properly, pricing experiments can lead to more effective, customer-centric pricing strategies, ultimately contributing to the overall success and competitiveness of the business.

Python-Based Techniques in Pricing Strategy

Harnessing Python for Data-Driven Pricing Decisions

In the era of big data, Python has emerged as a key tool for analyzing complex pricing data. Its versatility and powerful libraries for data manipulation, statistical analysis, and machine learning make it ideal for uncovering insights essential for informed pricing strategies.

Key Python Libraries and Techniques

- Pandas for Data Handling: Pandas is a fundamental Python library for data analysis. It is particularly useful for handling large datasets, cleaning data, and preparing it for analysis. Pandas can efficiently manage pricing data, competitor information, and customer demographics.

- NumPy for Mathematical Operations: NumPy is another critical library, especially for performing mathematical calculations. It can be used for operations like calculating average prices, price variances, and other statistical measures.

- SciPy and StatsModels for Statistical Analysis: For more advanced statistical analysis, libraries like SciPy and StatsModels come into play. They are used for hypothesis testing, which is essential in validating pricing strategies.

Simple Python Script for A/B Test Analysis

Here’s an example of a basic Python script that could be used to analyze the results of an A/B pricing test:

import pandas as pd

import scipy.stats as stats

# Load the dataset

data = pd.read_csv('ab_test_data.csv')

# Split the data into two groups

group_a = data[data['group'] == 'A']

group_b = data[data['group'] == 'B']

# Calculate the average revenue for each group

avg_revenue_a = group_a['revenue'].mean()

avg_revenue_b = group_b['revenue'].mean()

# Perform a t-test to see if the differences are statistically significant

t_stat, p_value = stats.ttest_ind(group_a['revenue'], group_b['revenue'])

print(f"Average Revenue for Group A: {avg_revenue_a}")

print(f"Average Revenue for Group B: {avg_revenue_b}")

print(f"T-Statistic: {t_stat}, P-Value: {p_value}")

In this script, we load pricing data from an A/B test, calculate the average revenue for each group, and then perform a t-test to see if the differences in revenue between the two groups are statistically significant.

Conclusion

Python offers a powerful suite of tools for pricing analysis. Whether it’s handling large datasets, performing complex calculations, or conducting statistical tests, Python can help businesses extract meaningful insights from their data. This, in turn, enables more accurate and effective pricing strategies, tailored to the market and consumer behaviors.

Integrating AI and Machine Learning with Pricing Strategies

- Enhancing Value Chain Analysis with AI:

- Predictive Analytics: AI can be used to predict future trends in cost and customer preferences, helping businesses anticipate changes in their value chain.

- Automation of Analysis: AI algorithms can automate parts of the value chain analysis, especially in identifying cost drivers and areas for efficiency improvements.

- AI-Driven Semi-Quant Expert Judgment:

- Enhanced Data Interpretation: Machine learning models can analyze large sets of market and consumer data, providing a more comprehensive backdrop for expert judgment.

- Bias Detection and Correction: AI can help identify and mitigate biases in expert opinions, leading to more objective decision-making.

- Optimizing Experiments with Machine Learning:

- Dynamic Pricing Models: ML algorithms can analyze data from pricing experiments in real-time, continuously adjusting prices based on consumer behavior and market conditions.

- Customer Segmentation: Advanced machine learning techniques can segment customers more effectively, allowing for more targeted and successful pricing experiments.

- Predictive and Prescriptive Analytics:

- Demand Forecasting: AI can be used for accurate demand forecasting, which is crucial for setting the right price.

- Price Optimization: Machine learning models can determine the optimal price points for various products and services, considering factors like demand elasticity, competitor pricing, and seasonal variations.

- Real-Time Market Analysis:

- Competitive Analysis: AI tools can continuously monitor competitors’ pricing strategies, providing insights for timely adjustments to your own pricing.

- Sentiment Analysis: Using natural language processing, AI can gauge customer sentiment from social media and review platforms, offering another layer of insight for pricing decisions.

Conclusion

By integrating AI and machine learning with established pricing strategies like Value Chain Analysis, Semi-Quant Expert Judgement, and Experiments, businesses can achieve a level of precision, adaptability, and foresight that significantly enhances their competitive edge. AI and ML not only streamline and augment data analysis processes but also bring real-time, predictive capabilities that are essential in today’s fast-paced and ever-changing market environment. The fusion of these advanced technologies with traditional pricing tools marks the next frontier in strategic pricing and revenue management.

Mastering Pricing Strategies for Business Success

Synthesizing Insights for Strategic Pricing

In the intricate dance of modern business, mastering pricing strategies is akin to finding the perfect rhythm. This comprehensive exploration of Value Chain Analysis, Semi-Quant Expert Judgement, and Experiments, augmented by Python-based data analysis techniques, equips businesses with a formidable toolkit. Each method brings its unique strengths – Value Chain Analysis provides a deep dive into internal cost structures and value creation, Semi-Quant Expert Judgement bridges the gap between hard data and market intuition, and Experiments offer empirical evidence of market responses.

The Path to Competitive Edge

Integrating these tools creates a synergy that allows for nuanced, dynamic, and effective pricing strategies. This integration is not a one-off exercise but a continuous process, adapting to market changes, technological advancements, and evolving consumer behaviors. In a marketplace where competition is relentless, such strategic agility in pricing is not just beneficial; it’s imperative.

Embracing the Future of Pricing

As we look to the future, the role of data analytics, particularly through tools like Python, will become increasingly significant in shaping pricing strategies. Businesses that embrace these methods, continuously innovate, and adapt their approaches will not only stay ahead of the curve but also pave the way for long-term success.

ThriveArk: Your Partner in ML-Driven Pricing Excellence. Discover how our AI innovation services can transform your pricing strategy. Automate and optimize your processes for a dynamic, data-driven approach. Stay ahead of market changes with ThriveArk. Connect with us today to revolutionize your pricing strategy!

References and Further Reading

- “Competitive Advantage: Creating and Sustaining Superior Performance” by Michael E. Porter – A foundational text on Value Chain Analysis.

- “Pricing Strategies: A Marketing Approach” by Robert M. Schindler – Offers insights into various pricing methods, including experimental approaches.

- “Python for Data Analysis” by Wes McKinney – A comprehensive guide to using Python for data manipulation and analysis.

- Harvard Business Review articles on Pricing Strategies – A resource for contemporary insights and case studies on pricing.

- “Statistics for Business and Economics” by Paul Newbold, William L. Carlson, Betty Thorne – Provides foundational knowledge in statistical analysis, useful for interpreting experiment results.

- Journals like the Journal of Marketing Research and the Journal of Revenue and Pricing Management – These offer academic and professional insights into the latest trends and studies in pricing strategy.

By exploring these resources, readers can delve deeper into each topic and continue to refine their understanding and application of these critical pricing strategies.